Excess Information Eligibility: Applicants must have a minimum amount credit score score of 600 and a minimal credit history of three decades to qualify for a LendingClub loan. Additionally, applicants must have a financial debt-to-revenue ratio of below forty% for single applicants and 35% for joint applicants.

Curiosity and fees fluctuate by point out — Your total financing cost (the quantity in desire and costs you you’ll fork out along with the quantity you borrow) can be extremely distinct from a single condition to the subsequent. So you'll want to browse the wonderful print of one's supply and contemplate regardless of whether it’s a cost you can cope with — and if it’s worth it.

Our editors are dedicated to bringing you unbiased scores and data. Our editorial articles is not influenced by advertisers.

The payment we obtain from advertisers won't impact the recommendations or tips our editorial team provides inside our article content or or else impression any in the editorial content material on Forbes Advisor. Even though we work hard to offer exact and up-to-date facts that we expect you can find relevant, Forbes Advisor would not and cannot warranty that any details supplied is complete and will make no representations or warranties in connection thereto, nor into the precision or applicability thereof. Here is a list of our companions who offer you items that we have affiliate back links for. lorem

To search out much more about your privateness when employing our Site, and to discover a far more thorough checklist for the objective of our cookies, how we rely on them And exactly how it's possible you'll disable them, remember to go through our Privateness Plan below.

These loans can have bigger desire costs and fees when compared with conventional loans, reflecting the higher possibility taken more info through the lender as well as convenience of speedy entry to money.

You will need to have a 640 minimal credit history rating (or Possess a creditworthy particular person to function a joint applicant).

Some states don't have to have licenses to offer payday loans, but some states do. Perform some investigation on the web to be aware of if your point out demands the lender to possess a license. In that case, then ensure the license is posted around the lender's Web site.

Installment loans for undesirable credit are secured or unsecured loans exclusively suitable for customers with damaged credit history scores. The loans are well suited for possible borrowers who tend not to still have an established credit history record.

But this doesn’t signify you must choose the first loan you can obtain without ensuring that you’re at ease with the terms in the loan.

Online direct lenders Provide you with access to the funds you'll need at aggressive prices. These lenders provide loans directly to you personally, they aren't loan brokers. Direct loan lenders is usually a fantastic alternative to common financial institution loans, especially if you only need a brief-time period loan.

MoneyKey won't think responsibility or liability for just about any actions taken by you in relation to this sort of Web-site and endorses that you review the data assortment tactics of these types of website. Cancel

We use info-driven methodologies to evaluate monetary solutions and corporations, so all are calculated Similarly. You may browse more about our editorial rules along with the loans methodology to the ratings below.

A line of credit history is really an open-ended borrowing alternative that you choose to submit an application for only at the time. A MoneyKey Line of Credit history can be utilized for unanticipated expenditures which will happen in the day-to-day life.

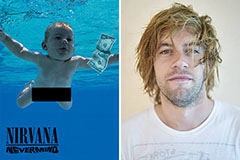

Spencer Elden Then & Now!

Spencer Elden Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!